Investing in Crypto Money: A Comprehensive Guide

Understanding Crypto Money

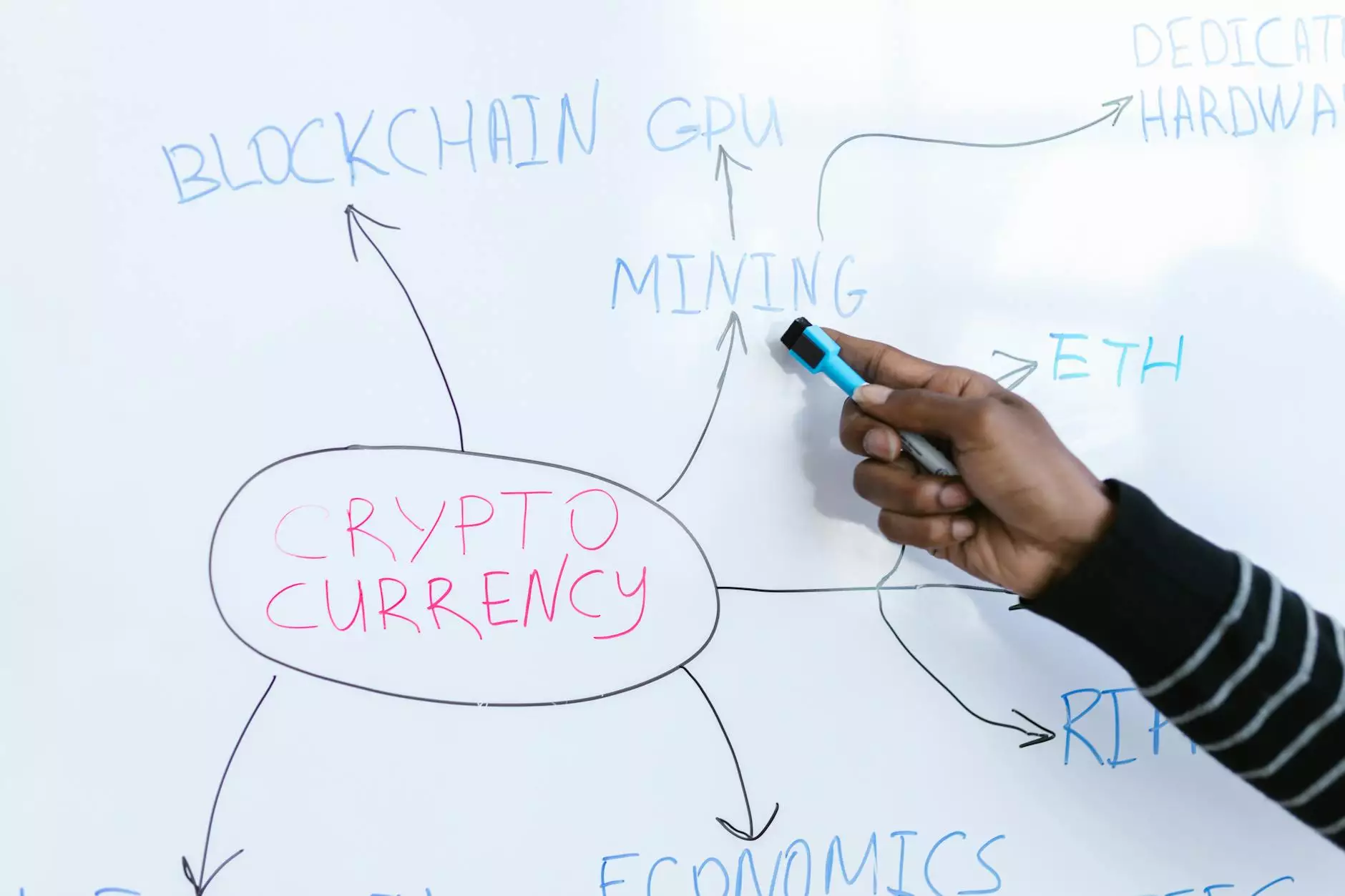

Crypto money, also known as cryptocurrency, represents a revolutionary form of digital currency that operates on blockchain technology. Unlike traditional currencies, cryptocurrencies function without a central authority, allowing for decentralized transactions. This innovation not only enhances security but also provides unparalleled transparency and efficiency in financial transactions.

Why Invest in Crypto Money?

Investing in crypto money can be a lucrative venture for diverse reasons:

- High Potential Returns: The value of cryptocurrencies can skyrocket in a matter of months, offering significant profit opportunities for investors.

- Diversification: Incorporating cryptocurrencies into your investment portfolio can provide a hedge against traditional market volatility.

- Innovation and Growth: The underlying blockchain technology continues to evolve, potentially leading to new use cases and value generation.

- Accessibility: Cryptocurrencies can be traded 24/7, providing investors the opportunity to engage in markets anytime, anywhere.

Choosing the Right Crypto Money to Invest In

The plethora of cryptocurrencies available can be overwhelming. Here are critical factors to consider when selecting crypto money to invest in:

Market Capitalization

Higher market cap cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) tend to be more stable, while lower market cap coins may offer higher returns but come with increased risk.

Technology and Use Case

Examine the technology behind a cryptocurrency and its real-world applications. Projects with strong use cases are poised for long-term growth.

Team and Development

A strong development team with a transparent roadmap can indicate a higher likelihood of a project's success.

Community Support

A vibrant community can drive a project's adoption and longevity. Look for active support forums and social media channels.

Strategies for Investing in Crypto Money

Once you have identified potential cryptocurrencies, employ these strategies to enhance your investment outcomes:

1. Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This strategy reduces the impact of volatility, allowing investors to accumulate crypto money over time.

2. Long-Term Holding (HODL)

The HODL strategy encourages holding onto your investments despite market fluctuations. This approach is especially effective for well-established cryptocurrencies with robust fundamentals.

3. Diversification

Don't put all your eggs in one basket. Diversifying your portfolio across various cryptocurrencies can mitigate risk and enhance overall returns.

How to Buy and Store Crypto Money

Acquiring crypto money to invest involves a few straightforward steps:

Step 1: Choose a Cryptocurrency Exchange

Research and select a reputable cryptocurrency exchange such as Binance, Coinbase, or Kraken. Ensure they are compliant with regulations and have strong security measures.

Step 2: Create and Verify Your Account

Once you've chosen an exchange, create an account and complete the necessary verification steps. This often includes providing identification and proof of address.

Step 3: Deposit Funds

After your account is verified, deposit funds via bank transfer, credit card, or other accepted methods. Ensure you understand the fees associated with deposit methods.

Step 4: Buy Crypto

With funds in your account, navigate to the trading section of the exchange. Select the cryptocurrency you wish to buy, specify the amount, and execute the trade.

Step 5: Secure Your Investments

Storing your cryptocurrencies securely is as crucial as buying them. Consider transferring your assets to a private wallet, either hardware or software, to mitigate the risk of exchange hacks.

The Risks of Investing in Crypto Money

While the potential rewards are substantial, it's essential to be aware of the risks associated with investing in crypto money:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically in a short period, which can lead to significant losses.

- Regulatory Risks: Different countries have varying regulations regarding cryptocurrencies, which can affect their value and legality.

- Security Threats: Online exchanges and wallets are susceptible to hacking and other security breaches. Always prioritize security.

The Future of Crypto Money

The landscape of crypto money to invest is ever-evolving. The future holds exciting possibilities as mainstream adoption increases and new technologies emerge. Factors such as:

- The integration of cryptocurrencies into traditional finance

- The rise of decentralized finance (DeFi)

- Increased regulatory clarity

All suggest a promising future for investors willing to navigate this dynamic market.

Final Thoughts on Investing in Crypto Money

Investing in crypto money can be an enriching journey, offering the potential for high returns and portfolio diversification. However, it is essential to conduct thorough research, understand the market dynamics, and remain vigilant about the associated risks. Whether you are new to crypto trading or looking to expand your existing investments, the key to success lies in informed decision-making and strategic planning.

Join the Crypto Trading Community

As you embark on your investment journey, consider engaging with the growing community of cryptocurrency traders. Platforms like social media groups, forums, and local meet-ups can provide valuable insights, support, and networking opportunities.

Further Resources

For more information and the latest updates in crypto trading, keep an eye on reputable blogs, podcasts, and news sites. Staying informed will empower you to make smarter investment choices in the exciting world of crypto money.

Explore our platforms at monetizevirtualfunds.software for more insights into crypto trading and strategies to maximize your investment potential.